As someone who stumbled down the rabbit hole and is yet to find the bottom, I recently stumbled upon the potential to invest in Mining on a smaller scale. By now you might also have acquired some BTC and are looking to increase it even more by making an investment. Large corporations are entering the Bitcoin mining space and are investing staggering sums of FIAT to mine as much of the remaining bitcoin as they can. Mining research includes, among other subtopics, what Bitcoin mining means, how it has worked in the past, what the current market structures are, what ASICs are available and maybe most importantly how you and I as individuals can enter this industry and make a potentially promising investment. The investment amounts necessary, just 13 years after Satoshi released the Bitcoin whitepaper, can be daunting and might discourage individuals seeking to make a profit from considering Bitcoin mining. One might get even more discouraged when finding out about cloud mining scams and other types of mining-related investments that promise more than they can keep. Electricity costs in your part of the world might keep you from considering this as anything more than a very expensive but unprofitable hobby. All the while, decentralisation is at the core of Bitcoin. The more individuals take part in Bitcoins growing mining economy the better.

During my research, I came across the investment proposals of Compass Mining and Blockstream’s Mining Note (the BMN). From what I can tell these are among the most popular in the community and I have invested in both. This article is supposed to help and guide you in starting to understand the differences between the investment possibilities that Compass and Blockstream are offering. Complementary to this article, I will also share two Google spreadsheet templates, which can be used to modify to your liking. Similarly, I will leave the reader with a plethora of links to follow up on, that helped during my research. I will be reporting on the performance of my investments monthly, so feel free to follow along.

Companies

Don’t trust, verify! This is one of the most common mantras echoed in the Bitcoin community, and for good reason. Bitcoin is revolutionary, partly because for the first time humanity has access to money that needs no central coordinator to function. Everything in Bitcoin can be verified by anyone. Nothing needs to be trusted. Of course, not everybody runs their own node and stakeholders do trust parts of the network, but the important point is that this is not a requirement. This fact alone creates more trust in the network as the risk of being exposed is high.

Be that as it may, the same cannot be said for making investments. In general, when you make an investment you automatically subject yourself to some form of counterparty risk. In the case of mining investments, it is no different. To better assess the counterparty risk, I want to give you a brief introduction to the aforementioned companies and leave you with links to do some more in-depth research.

Blockstream:

Blockstream was founded in 2014 by Adam Back, Erik Svenson, Pieter Wuille, and others. Their main mission is stated as follows:

We are long-time Bitcoin protocol developers who are convinced that finding an architecturally sound and permissionless way to extend Bitcoin is essential for cryptocurrency to reach its full potential. Bitcoin has inspired people since its inception as a new kind of money in digital form that exists independent of any government or institution. Bitcoin enables financial transactions without needing to trust any third party.

The full background of Blockstream’s founding story can be found on their website. Adam Back is the developer behind Hashcash and financial applications for Proof-of-Work. His developments have had a meaningful impact on the later development of Bitcoin and are cited in Bitcoins whitepaper as well. If you are interested in the history before the whitepaper was released, I can only recommend you read “The quest for digital cash” by Alex Gladstein.

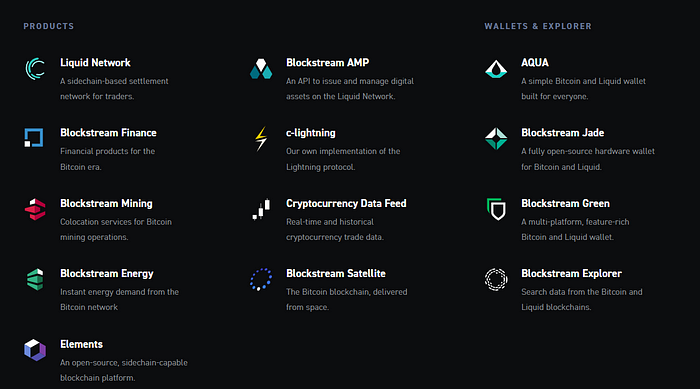

Blockstream offers a range of products which include Hardware Wallets, Mobile Mining Units, Hosting Services, BMN and Blockstream Satellite. They are also meaningfully contributing to the lightning network and have developed a sidechain-based settlement network called the “Liquid Network”.

The company recently completed a $210 million raise to become a larger player in the manufacturing of ASIC Miners, which further decentralises this critical part of the bitcoins economy.

Compass Mining:

Founded in 2020, Compass Mining is a relatively young company.

Their mission is stated as follows:

We are a bitcoin-first company on a mission to support the decentralized growth of hashrate and strengthen network security by helping more people, learn, explore and mine bitcoin.

The company was founded by White Gibbs, Thomas Heller and Paul Gosker. Including the three founders, the company currently lists 11 employees on their website. The company is much more service-oriented as its product and its offerings are more directly designed for individuals to enter the mining business. Members of their team are very active on Twitter and try to engage with the community frequently. Compass hosts a larger Discord channel with hundreds of customers, support staff, sales managers, etc.